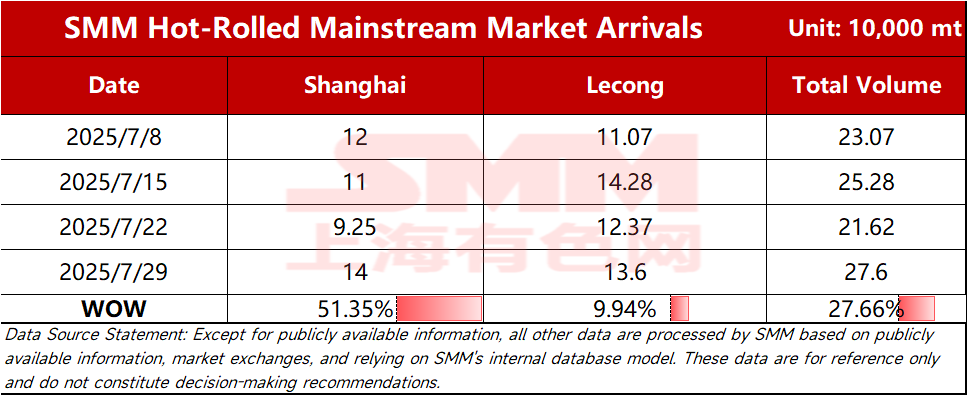

SMM Steel reported on July 29 that according to SMM statistics, the estimated total shipments of resources in major markets this week were 276,600 mt, representing a 27.66% increase in shipment levels compared to last week. By market:

Chart-1: Comparison of Arrivals in Major Markets

Source: SMM Steel

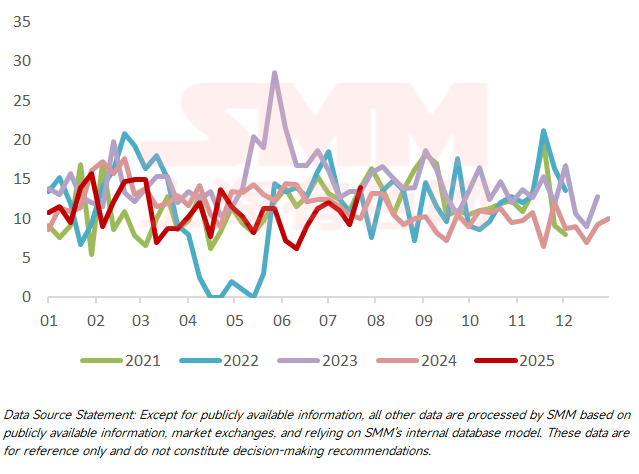

Shanghai market: Shipments in the Shanghai market increased significantly on a WoW basis this week. Specifically, shipments of resources from north-east China and east China remained stable, while shipments from north China decreased. However, shipments of WG, a mainstream resource in south China, rebounded significantly. Looking ahead, with the recent strengthening of HRC prices driven by news, merchants have shown good enthusiasm for ordering, and arrivals in the Shanghai market are expected to fluctuate at a medium-to-high level in the short term.

Chart-2: Arrivals in the Shanghai Market

Source: SMM Steel

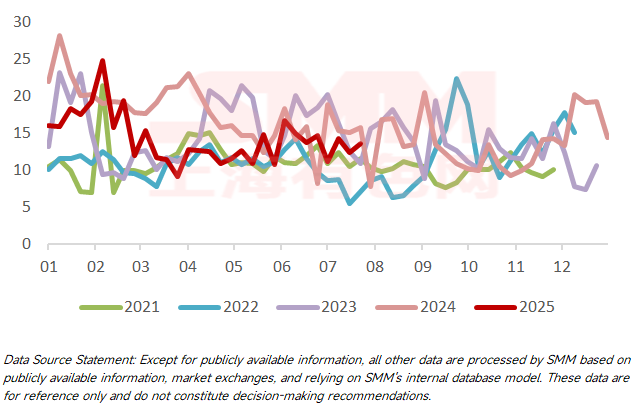

Lecong market: Shipments to the Lecong market increased slightly on a WoW basis this week. Specifically, on the one hand, arrivals of resources from north China remained stable. On the other hand, shipments of the local mainstream resource DDH increased, leading to a slight increase in overall arrivals this week. Looking ahead, with the recent significant increase in spot prices in Lecong and a narrowing of the price spread, it is expected that the short-term arrival level in Lecong will continue to remain at a medium level.

Chart-3: Arrivals in the Lecong Market

Source: SMM Steel

SMM releases data on HRC shipments to major markets every Tuesday. To subscribe or follow more data, please scan the QR code below.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)